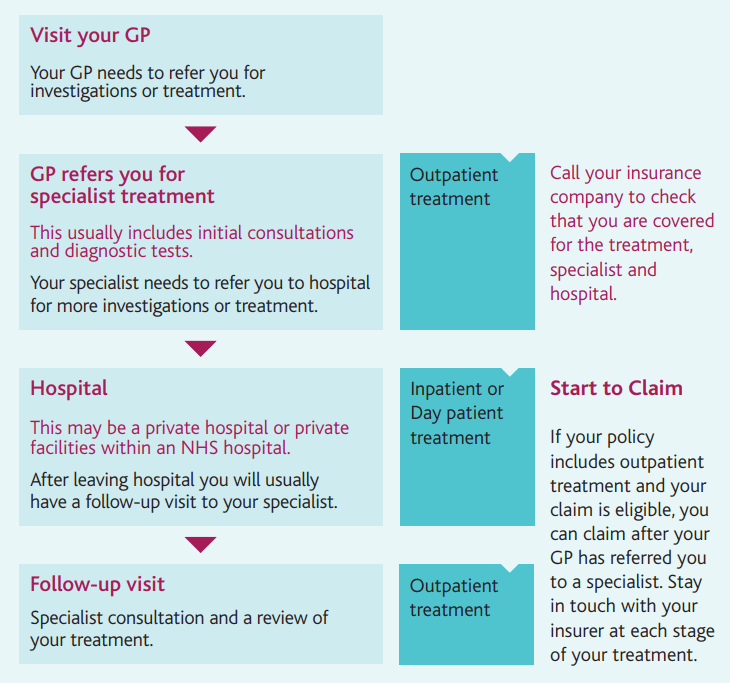

How you receive treatment falls into one of three categories.

Outpatient - A patient who attends a hospital, consulting room, or outpatient clinic and is not admitted as a day patient or inpatient.

Day patient - A patient who is admitted to a hospital or day patient unit because they need a period of medically supervised recovery but does not stay in a bed overnight.

Inpatient - A patient who is admitted to hospital and who stays in a bed overnight or longer, for medical reasons

What are the benefits of Private Medical Insurance?

The purpose of health insurance is to help you pay for care in the event of an unexpected serious illness or injury. Due to the pressures on the NHS private medical insurance has become popular for a number of reasons:

Faster care - Not having to wait for NHS treatment

More treatment choice - Access to more of the latest life saving drugs and treatments

Faster diagnosis - Getting the scans and investigations you want done quickly

Privacy - Getting a private room

More expertise - Specialist referrals and second opinions

Choice of consultant - Choose your surgeon and hospital

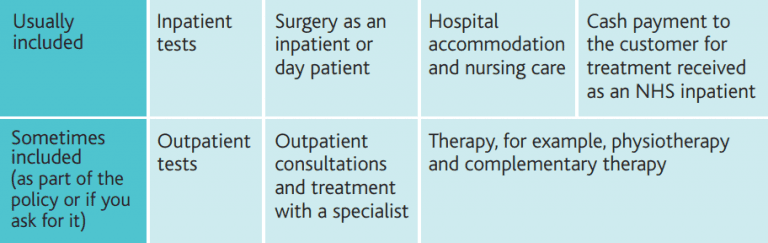

Private medical insurance is for acute (curable) conditions only. These respond to treatment/medication and return you to the state of health you were in before, or lead to a full recovery. Depending on the plan you choose cover may include:

- Outpatient treatments

- Day-patient treatments

- In-patient treatments

The benefits of being a private patient will depend on your policy and the options that you choose, but could include:

- Shorter waiting lists than the NHS

- Access to a wider range of treatments than are available on the NHS

- Private rooms, possibly with own en-suite

- Additional Facilities such as a television

- Private nursing and additional support

There are a number of ways you can customise health insurance plans to make your plans cheaper, essentially you remove/reduce the elements of cover not high on your priority list.

Six week option: If the NHS is able to provide treatment within six weeks, you will be treated on the NHS. However, if the NHS cannot guarantee treatment within six weeks you can use your health insurance policy to be treated straight away.

Excess: The higher the excess on your policy, the lower your premiums. This is especially useful on budget plans where claims are likely to be only in the event of a severe medical condition (like cancer).

Co-payment: On some plans it is possible to volunteer to pay a percentage of any claim which will reduce your premium.

Restricted hospital lists: By researching which hospitals are available on cheaper lists you can remove hospitals you do not need (often removing London hospitals will dramatically reduce the premiums).

Some providers offer incentives and discounts to individuals who can either demonstrate a good level of fitness at the time they take out their plan or even whilst the plan is in force.

Often these discounts and rewards are applied on or after application and not all companies provide them. If you feel that this applies to you we would suggest you get in touch with us directly.

Yes, you can add your partner and/or your children (including newborn or adopted children) as dependants on your policy.

Some providers offer discounts for having additional family memebrs on one plan

The majority of us feel better if we are treated in a hospital that we are familiar with which is as close to home as possible, or in a hospital well known for expertise in certain conditions or treatments.

Some providers give you a choice of up to three hospital networks, so that you can choose not to pay for hospitals you don't need or want.

It doesn’t usually cover treatment of long-term (chronic) conditions, where the main aim is to keep the symptoms under control (like diabetes) – that would make premiums much more expensive.

Private medical insurance also won’t cover any pre-existing conditions you may have when you take out a plan.

There are some standard treatments and conditions that most providers don't cover. These are:

- Any treatment you receive outside the UK

- Emergency treatment or visits to your NHS GP

- Pregnancy, childbirth and most related conditions

- Cosmetic treatment

- Organ transplants

- Any treatments or practices that are experimental, unproven or unregistered

- Any treatment for learning difficulties, delayed speech disorders and other developmental problems

An excess means that you have to pay a small fee when you claim (usually £100) or part of any eligible treatment costs, it is possible to have no excess at all and most providers will have a number of choices so that you can customise the plan to your budget.

Full Medical Underwriting is usually a slightly cheaper option, your medical history will be taken over the phone so you will need to be prepared to answer questions.

As your medical history is known you will be told of any specific exclusions when you buy. However exclusions will remain for the life of the plan!

Moratorium Underwriting excludes any condition, disease, illness or injury or related condition, whether diagnosed or not, which you or your dependant in the last 5 years:

- received medication for

- asked for or received, medical advice or treatment for

- experienced symptoms of, or

- were to the best of your knowledge aware existed

Most providers however will cover these conditions after your policy has remained live for 2 years or longer and there has been no further: medication, symptoms or medical advice required relating to the issue in question.

The point is that the exclusion's may not be permanent!

Yes you can cancel most plans at any time, however the following rules apply with most plans:

- If you cancel within the first 30 days you will receive a full refund

- If you cancel the plan within 12 months of taking the contract you may have to pay a cancellation charge which varies between provider

- When your plan comes up for renewal after 12 months you are free to change provider or cancel your plan

An EHIC lets you get state healthcare in other EEA countries and Switzerland at a reduced cost or sometimes for free.

Almost all private medical insurance contracts are for 12 months