These plans aim to provide cashback benefits on selected medical care at private hospitals. This means that you are able to choose any private hospital in the UK, pay for your treatment and then be reimbursed for that cost for a fraction of the cost of traditional private medical cover.

Self-Pay Cash Plans

When you get a new condition, instead of choosing to wait on the NHS and possibly experience stress and uncertainty for a number of months, you pay for treatment at a private hospital and get reinbursed on those costs.

Self-Pay Cash Plans provide you with easy access to private medical treatment on new conditions diagnosed after your plan has started.

Although you do have to pay for the treatment upfront you get reinbursed up to your cover limit (which you can choose). This allows you to benefit from faster effective treatment without paying the higher costs associated with a traditional health insurance policy.

Claims Process provided by April UK

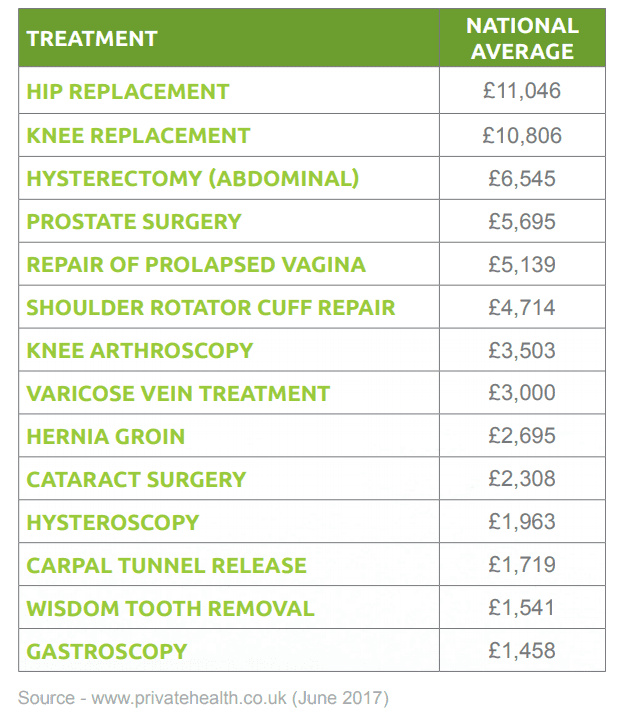

What does a treatment cost?

The actual cost of private medical treatment can vary dramatically depending upon the illness/injury.

To help you decide on the level of cover most appropriate for your needs; here is a guide on what you can expect private treatment to cost in a variety of circumstances.

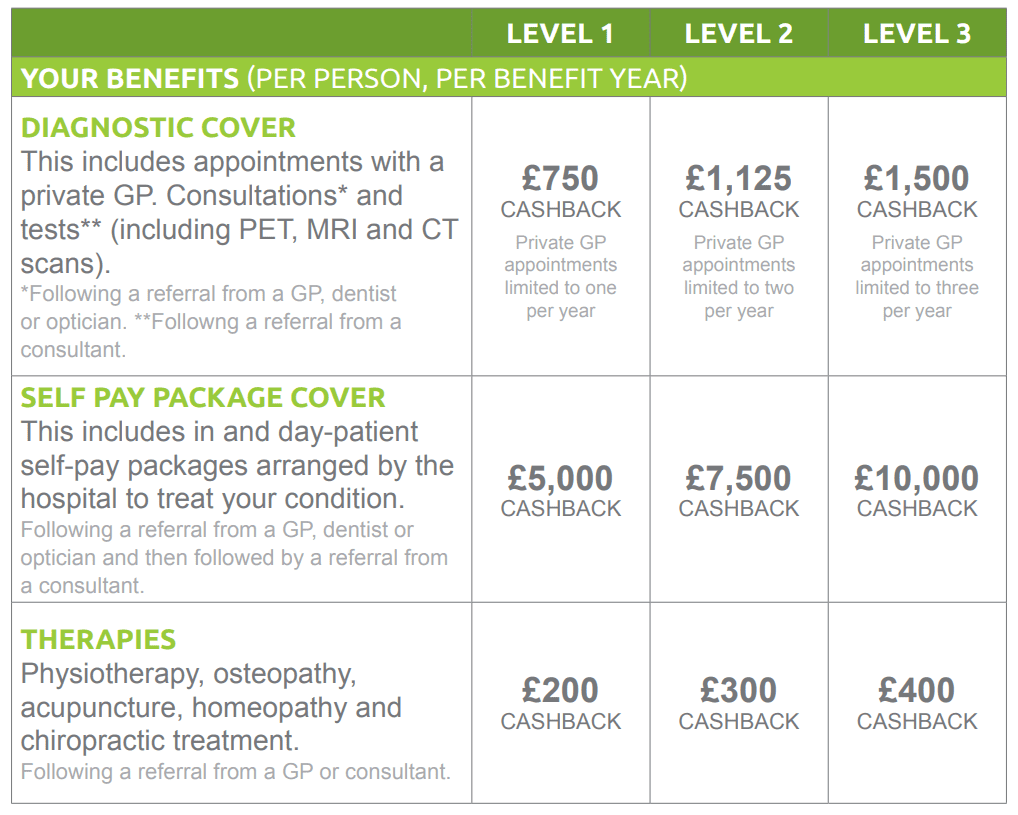

Treatment falls into one of three categories.

Diagnostics - When you need to get a fast diagnosis using private consultants for improved chances of recovery and peace of mind!

Self-Pay Package Cover- You agree the treatment and care required with your consultant, pay for the care and claim for reinbursement.

Therapies - These are the treatments that you may require following surgery or an accident that you can get reinbursed for.

What is a "Self-Pay Package"?

A ‘self-pay package’ is predetermined by the hospital prior to treatment taking place and the costs will be negotiated by the patient. Typically it will include:

- Pre-operative assessment

- Hospital accommodation and meals

- Nursing care

- Hospital theatre fees, drugs and dressings whilst in hospital

- Surgeon and anaesthetist fees whilst in hospital

- Any necessary prosthesis where the procedure you undergo requires it

- X-rays, scans, physiotherapy, pathology, histology needed whilst in hospital

- Take home drugs for up to 14 days following discharge as prescribed by treating consultant

- Post-operative care where clinically required by the treating consultant including, removal of stitches, dressings or plaster, tests and scans and one follow-up consultation.

* Whenever you agree a self-pay package with a hospital, you will always receive an Admission Letter. This will detail exactly what is included in your package and you should always check it thoroughly to ensure it meets your requirements.

Reviews

Excellent Service We have been using Andy to arrange our life insurance for over 5 years now and he has always provided a friendly, reliable and personal service. We would highly recommend him to friends, family and anyone else considering reviewing their life insurance needs.

Great job very friendly, and everything set out and explained to me. Found me some great deals and set it all up for me hassle free. Would highly recommend to anyone

Recommended without reservation. A most professional service.

Extremely helpful (and patient) throughout the switch to our new Life Insurance policy. They chased each staging post along the way on our behalf and regularly made contact to keep us informed. Great service!

The advisor Andrew was very polite, efficient and found the best life insurance that suited my needs

Professional service, very helpful, clear and concise guidance. Andy provides impartial advice, helped secure the best life insurance deal and provided a superb will writing service.

My enquiry was dealt with very professionally by Andrew Burton. Everything explained in detail and in such a friendly manner. I was more than happy to put my life insurance in place,and would strongly recommend this site. K.McCarthy.

A very good detailed quote well presented and a very friendly person who gave me a couple of quotes and was very good at his job I would strongly recommend this company

FABULOUS How thorough , knowlegable and patient is Andy Burton THE one for all you security needs .. Peaceful times ahead Thank you

Extremely brilliant service and very informative and staff are very helpful

Excellent in all respects. Friendly, efficient and clearly explained everything. Would highly recommend.

Very relaxed advisor ,made me feel at ease.Excellent level of knowledge.I felt absolutely no pressure.Thank you Andy.

He was very efficient and professional throughout our telephone conversations. I would certainly recommend Andrew Burton - owner of Sandbourne. I will certainly be using him in the future with other matters and I will recommend him to friends and family.

Great website! Totally hassle free, efficient and friendly advice. Given all the options to look through to decide what was best for me. Would highly recommend!

We are so pleased that we went with this company. Such a lot of help, and nothing was too much trouble. At a time like this it is hard to know what to do and how to do it, but the advice was there straight away and we were put at ease immediately. Without any hesitation we would recommend this Company.

I have been dealing with Andy since my son was born in 2012 and even now he still helps me even when on holiday with his Wife (he got a telling off by me lol) I will never go to anyone else as long as Andy is still doing the same job!

Difficult subject made easy. Many thanks for your easy to talk telephone quote.I had difficulty with my computer bombing out at the time of looking for this, but I would have no hesitation in calling for help in the future. Thank you Andrew Burton. Regards Sandra Saunders.

Brilliant 5* Brilliant service throughout! Thank you so much.

Andy was extremely helpful and polite...I explained what I needed, and he delivered. Simple.

Lovely experience! Such a friendly, easy experience! Andy Burton took the time to explain every option thoroughly, to listen to exactly what it was we wanted and we never ever felt rushed. He was equally professional and friendly and immediately put you at ease. Things were explained so well to ensure I understood everything and every option thoroughly! It was a much more personal experience then we have had with other companies and I would honestly recommend this company to everybody!

Excellent service Andy is a first class professional, what stands out is his integrity and his commitment to you as a client. He is knowledgeable and his foremost intention is to obtain the best deal for your circumstances. Do not hesitate to give him a call, even if its only advice you are seeking. The discussion you have will ultimately only benefit your future decisions regarding life cover, health insurance…. etc.

Fabulous first rate service Never described Insurance shopping as a pleasant experience before but this really was. Andrew is fantastic, very knowledgeable and sells you what you need. No hidden extras or fees and the free will with every policy is brilliant. I would have no hesitation in recommending Andrew.

very friendly, efficient and informative and took time to explain things. I work for a large company and would definitely recommend to my work colleagues, of which I will.

Extra mile It is always important to have all the facts before you commit to anything - like crossing the road, is there any cars coming? Andy ensures that all the facts are well explained and offers a no frills and no B*** S*** answers to all questions.

Positive experience Very helpful, personal service that was much more informative than other, much-advertised operators who were more about getting my business than ensuring it was appropriate to my needs.

Policy to cover funeral costs Very helpful advice, well explained. Not intrusive and job done.

Knowledgeable and efficient Very impressed with the level of service provided, Andrew was very knowledgable about the various insurance options and provided clear straightforward advice in an efficient manner. Andrew helped us to obtain value for money and the right insurance product for us and made things simple. I would not hesitate to recommend to friends.

Quotation for PMI Extremely helpful ... Andrew gave a complete justification for his recommendations.

Great service, great product We were given a recommendation for lfie insurance and income protection insurance. We weren't disappointed, the quotes were better than anywhere else we'd found, the service was brilliant - both personal and convenient as they called when requested and keep following up when you were trying to make decisions. The whole process from initially talking to Andy, all the way through to receiving our documentation and setting up the direct debit, was so easy and stress-free.

WE ARE

My Insurance Hub is one of the UK’s premier comparison sites, working for customers to make sure they get the best deals on insurance. Whether it's a new product you're after, an upgrade or renewal, you're in safe hands.

- No Hidden Charges

- Peace of mind

We want to make sure the right quote is with you in minutes.

You must be:

- Between the ages of 18 and 69 inclusive

- Resident in the UK, Isle of Man or Channel Islands

Simply call the provider to confirm your cover and request a claim form, which you’ll need to complete and return.

The provider will also require a referral letter and an original receipt showing that an expense has been incurred, or a letter from the hospital, doctor or specialist showing that a medical treatment/service has been used.

Any benefit due will be paid directly into your bank account by the provider.

› Chronic conditions (Diabetes, high blood pressure, etc.)

› Pre-existing conditions

› Cosmetic procedures

› HIV/AIDS or any related medical condition

› Pre-existing medical conditions

› Pregnancy, childbirth and fertility

› Preventative treatment

› Selected sports and hazardous pursuits

› Self-inflicted injury or illness

All conditions you are aware of, or in the opinion of the provider should be aware of, or have received treatment, are automatically excluded, unless you are symptom free and do not receive treatment or advice for the two years following your plan start date.

Yes, you can add your partner and/or your children (including newborn or adopted children) as dependants on your policy.

Some providers offer discounts for having additional family members on one plan

On a hospital cashback plan you can use any hospital

Waiting periods will apply on selected benefits. Please refer to the Policy Document for full information.

On the self-pay hospital plan there in no excess to pay

Full Medical Underwriting is usually a slightly cheaper option, your medical history will be taken over the phone so you will need to be prepared to answer questions.

As your medical history is known you will be told of any specific exclusions when you buy. However exclusions will remain for the life of the plan!

Moratorium Underwriting excludes any condition, disease, illness or injury or related condition, whether diagnosed or not, which you or your dependant in the last 5 years:

- received medication for

- asked for or received, medical advice or treatment for

- experienced symptoms of, or

- were to the best of your knowledge aware existed

Most providers however will cover these conditions after your policy has remained live for 2 years or longer and there has been no further: medication, symptoms or medical advice required relating to the issue in question.

The point is that the exclusions may not be permanent!

Yes you can cancel most plans at any time, however the following rules usually apply:

- If you cancel within the first 30 days you will receive a full refund

- If you cancel the plan within 12 months you may have to pay a cancellation charge which varies between provider

- When your plan comes up for renewal after 12 months you are free to change provider or cancel without charge.

The Diagnostic Cover benefit will provide cash back benefits for consultations and diagnostic tests so getting a crucial fast diagnosis is still covered.

However cancer treatment such as surgery, drugs, radiotherapy and chemotherapy are unlikely to be available from private hospitals as a self-pay package. Therefore this type of treatment is unlikely to be covered on your Hospital Self-Pay Cash Plan.

A ‘self-pay package’ is predetermined by the hospital prior to treatment taking place and the costs will be negotiated by the patient. Typically it will include:

- Pre-operative assessment

- Hospital accommodation and meals

- Nursing care

- Hospital theatre fees, drugs and dressings whilst in hospital

- Surgeon and anaesthetist fees whilst in hospital

- Any necessary prosthesis where the procedure you undergo requires it

- X-rays, scans, physiotherapy, pathology, histology needed whilst in hospital

- Take home drugs for up to 14 days following discharge as prescribed by treating consultant

- Post-operative care where clinically required by the treating consultant including, removal of stitches, dressings or plaster. Tests and scans. One follow-up consultation.

Whenever you agree a self-pay package with a hospital, you will always receive an Admission Letter. This will detail exactly what is included in your package and you should always check it thoroughly to ensure it meets your requirements.