WPA – Private Health Insurance Review

WPA has become extremely popular in recent years and one of the most well-regarded providers of Private Health Insurance in the UK, so we decided to take the time to take a look at the reason for all this fuss.

Firstly WPA Health Insurance is a not for profit organisation without shareholders; as such they do things a little differently to the rest of the market.

As one of the few brokers authorised to discuss their proposition we thought we would provide a review of the WPA Health Insurance options available to individuals under the age of 65, which is currently the maximum age they will take on new customers for their flexible health plan.

*This review was written in 2021 and relates to the Flexible Health plan only, this plan whilst still in use by thousands was discontinued to new customers in October 2023. WPA now sell their Complete Health product to new customers which has a number of differences.

WPA Customer Reviews

Before we go in to our opinion it is good to start with what WPA customers think, and their experiences with claims.

WPA have nearly 800 reviews and are rated as Excellent on Trustpilot with a score of 4.8 out of 5, making them the highest independently rated Health Insurance provider on Trustpilot.

A quick browse of their customer feedback reflects how they are often shown to provide a more personal service than many of the larger providers. Reassuringly many of the reviews are regarding claims experience and not simply that the plan was easy to purchase.

WPA will not increase your price if you claim!

This is arguably the most important benefit members of WPA receive above other health insurance providers. Their policy is “community rated” which means they do not use a no claims discount system.

With other health insurance providers, when you take out a new private health insurance policy you start with the maximum no claims discount (NCD). Because you do not build this up over time and simply start with the maximum, your plan will not get cheaper if you do not claim, but they will remove the discount if you do.

This means that a no claims discount is used as a method of punishing those who claim, rather than rewarding those who do not!

How does this compare with other companies?

Some companies like Bupa or Vitality for example do not allow anyone to protect their NCD.

Even those that do allow you to pay extra to protect your no claims discount like Axa or Aviva have problems. On claims that run for a long period, the protected NCD is removed the following year after you claim.

You can only reinstate a protected no claims when you have no issues in the 12 months prior to your renewal (so they still might increase your price on year 2 and beyond).

Quite simply with WPA the price is the price, whether or not you claim during the year.

We believe that health insurance is there to be used when you need it, so not having to worry about how much your price will increase if you claim is a huge benefit to WPA customers above the competition.

Crucially this means if you are unlucky enough to be claiming for an illness (like cancer) where the claims can continue for many years, you will not be trapped with spiralling premiums.

Discounted Health insurance for Business owners and Professionals

There is a 20% discount on health insurance for self-employed, business owners and professionals under 55. After age 55 the discount will reduce by 2% a year until age 65.

This makes the WPA plan extremely popular with members of professional institutions such as Dentists, Solicitors, Teachers, Surveyors and Accountants.

To check if your profession qualifies you can find their list here

For the self-employed the discount is available if you are:

- Director of a limited company

- Partner within a partnership/LLP

- Holder of a franchise agreement

- Recognised as self-employed by HM Revenue & Customs

Is WPA a Comprehensive style insurer?

Yes, WPA have a variety of plans available.

Both the “Premier” & “Elite” plans can be considered to be comprehensive. This is due to not having an upper cap on the maximum annual benefit. We will be focusing on those two plans in this review!

As with all comprehensive plans all your in-patient and day-patient costs are covered in full as standard. You will also have MRI, CT and PET scans included with a number of other benefits.

Cancer Coverage:

Cancer treatment is included as standard on the WPA Elite plan, and is an optional extra on the Premier policy.

We would almost always suggest it is worth including full cancer care unless it would be excluded as pre-existing anyway.

If you are on their Elite plan or have included the cancer add-on with the Premier plan, then coverage is very good indeed:

No limit for:

- Diagnostics – Consultations with a Specialist including second opinions, diagnostic tests, scans and biopsies

- Surgery

- Radiotherapy/Chemotherapy

- Targeted Cancer Therapies – Advanced anti-cancer treatment (Targeted Cancer Therapies) will be funded when given with curative intent, where not readily available on the NHS

One of the best (if not the best) choices for Hospitals & consultants on the market!

Hospital choice:

The WPA standard list will allow you access to over 600 private hospitals in the UK.

These include all the BMI, Nuffield, Spire & Ramsay hospitals.

There are a few hospitals mostly in central London which can be added by paying a little extra on their “premium hospital list”.

The Elite policy even provides emergency medical treatment abroad up to £500,000 (Not USA & dependencies).

Consultant choice:

The current trend among health insurance providers is to offer something called a “guided” or “consultant choice” option.

WPA do not offer this, as a result it is always YOUR choice who treats you!

A guided option is where the insurance company (or selected consultants) choose who will treat you, rather than it being your choice.

Although this can result in cheaper premiums you are giving up control. In most cases the consultant the insurance company will choose is likely to be someone who charges less!

All consultants will obviously be qualified, however those who charge less are unlikely to be at the top of their field of expertise!

WPA are popular with consultants & surgeons themselves as they do not attempt to dictate treatment plans to consultants, they let the experts decide.

This is why some top consultants have been known to refuse to work with well-known health insurance providers.

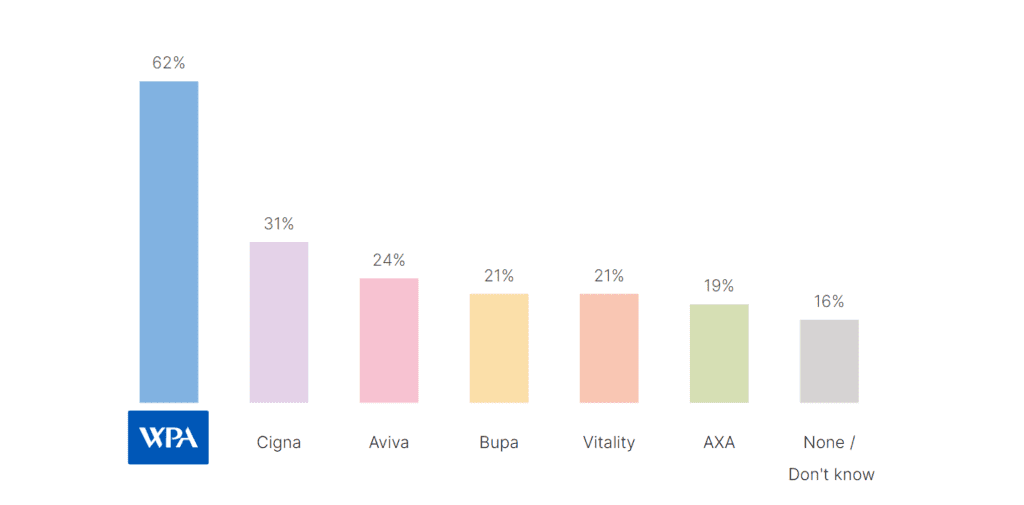

An independent survey by Populus showed that WPA was by far the most recommended provider by consultants. Recommended by 62% of those surveyed (double that of the next best provider Cigna).

Which consultants are available with WPA –

To search for a specific consultant or facility with WPA use the following link – WPA Consultant / Hospital search

What is a Shared Responsibility Excess?

WPA do not operate a traditional excess system like other providers, instead they use a “co-payment” system where you simply contribute 25% of the value of your claim up to a limit you choose and WPA will cover 100% of the bill beyond that.

This means your Contribution is capped but the insurance companies contribution is not!

The higher the shared limit you choose the cheaper your plan will be, so if you have savings it can make more sense to have a higher shared responsibility limit in order to get your price down substantially.

Example if you have a £250 co-payment limit:

- For a small claim where you need to see a specialist, that specialist may charge £150. You pay £37.50, WPA would pay the remaining £112.40.

- If the claim was larger, such as a few sessions of chemotherapy could be £15,000. You pay £250, WPA would pay the remaining £14,750.

This works very well for claims where you just want to get something checked out quickly.

With a “traditional” £250 excess from other providers, you would pay £250 regardless of the size of the claim.

You may even decide not to claim at all because you would be worried about the impact on your no claims discount. This would not be an issue with WPA as there is not a discount to lose!

Mental Health

WPA recently updated their plans to include mental health support following feedback from customers and the rising concern of customers in this area.

When included, up to 28 days of cover will be provided on an in-patient or day-patient basis, as well as £1,000 of cover per year towards Psychotherapy, Psychiatrist and Psychologist appointments.

WPA will also provide up to 20 sessions per year of “Structured Counselling” if the mental health upgrade is included, this option can also be purchased seperately as cheaper alternative to their full mental health cover.

Health and Wellbeing Helpline – This is a telephone support service covering a wide range of situations.

Outpatient coverage:

Being able to claim for outpatient diagnostics and specialist consultations is the most common reason to claim.

With NHS waiting lists at an all-time high getting specialist advice quickly for non-life threatening issues is still extremely important.

After all you may not wish to wait 8 months to see someone about why you are suffering headaches or the pain in your knee!

These claims are usually smaller as they tend to only involve seeing a specialist and getting diagnostic tests done, however it is also one of the areas claimed on most commonly.

Premier Outpatient options:

With WPA you can have a minimum of £300 outpatient cover to save money, or you can increase the limit to £1,000 or £1,500 on their premier plan at an increased cost.

Our research shows that £1,500 is often a similar price to £1,000, so usually it makes more sense to go for the higher limit.

Elite Outpatient:

On the Elite plan outpatient coverage is included as standard on an unlimited basis, covering all costs towards consultations and diagnostic tests.

They will cover up to £1,000 towards diagnostics recommended by your GP if you have not seen a specialist. This is something most providers would not pay for.

Dental and Optical cover:

This is included as standard on the Elite policy and optional on the Premier.

The costs of including the cover are often low. We believe this is worth including to help with check-ups, dental emergencies and the cost of new glasses/lenses.

- General Dental Treatment

- Dental Emergencies

- Dental Injuries

- Restorative Treatment as a direct result of Oral Cancer

- Optical Treatment

*Annual limits apply to these benefits which can vary depending on your choice of plan

Is it easy to claim with WPA?

Although you hope never to need it, if the worst happens you want a provider who makes the process easy. Certainly going by the customer experience recorded on Trustpilot it would seem you are in safe hands.

WPA use a health app which makes the process very straight forward; in many cases the app can make an instant decision for you.

You can still claim over the phone, and as with other insurers never delay before claiming. You do not need to worry about losing your no claims bonus so there is no reason not to claim.

Do WPA provide access to a video GP?

Yes, WPA give access to a private GP via phone or video. Members can call the advice line and speak to an operator who will arrange for a GP to make contact.

The GP will hopefully be able to provide a referral or diagnose the issue in question.

This benefit has been particularly useful during the Covid pandemic as GP surgeries became overwhelmed. It is also useful for members who have a problem whilst abroad.

Underwriting options:

When you take a plan out with WPA you have a choice as to how they underwrite you (decide what is excluded).

- Moratorium – WPA don’t require your medical history but symptoms, treatment or advice for conditions in the last 5 years will be initially excluded. More information may be required when you make a claim.

- Switch – For those transferring from another insurer, ideally avoiding new exclusions.

- Full Medical Underwriting (FMU) – Details of your past medical history are required, usually recent or ongoing medical conditions will be excluded.

Unlike other providers WPA do not change the price of the plan based on how your policy is underwritten.

Underwriting is simply used to determine what can be considered to be pre-existing.

Which is best for you will depend on your current situation, so for advice in this area get in touch and we will be happy to help.

What are the standard exclusions on WPA Health Insurance?

As with any provider there are a number of situations that will not be covered.

Here is a list of the key exclusions; (check your policy documents as the full list will differ depending upon your plan choice and options)

- Pre-existing conditions

- Long-term chronic conditions

- Cosmetic/aesthetic treatment

- Emergency treatment – These would be dealt with at A&E as normal

- Fertility problems, pregnancy and childbirth

- Mental health conditions

- Injuries sustained through winter sports, scuba diving or motorsport

Are there any other discounts available with WPA?

Yes, currently WPA are offering an additional 25% off their plans in the first year for personal clients. You will also get 15% off in year two and 5% off in your third year of insurance.

This is on top of any discount for being a professional or self-employed.

Summary:

Our view of WPA is that they are fairer to customers in the long-term, whilst providing an excellent choice of consultants and hospitals.

Not just looking to provide a low price to attract new customers;

Unlike other providers who have the ability to increase the price to potentially unaffordable levels should they start to claim, WPA believe worrying about the impact on your price next year defeats the point of having private healthcare.

By removing the no claims discount system and giving the same price to all existing customers regardless of the number of claims, WPA are doing more to look after their members long term than any other provider.

The shared responsibility excess system although different from other providers makes sense; your contribution is low if the claim is small. The claim is capped at a figure you know your savings would cover if the need arose.

Consultants view WPA favourably compared to any other provider, which in itself is a good reason to consider them.

When combined with a discount on health insurance for directors, professionals (Dentist, Teachers, etc.) and the self-employed, it makes the plan especially affordable.

How do WPA compare with other providers on price?

We conducted some research in to the cost of private healthcare. For a 40 year old self-employed, non-smoker, living on the south coast.

The comparison shows a comprehensive plan with:

- Outpatient cover included for £1,000 per year

- Therapies

- Each provider’s standard national hospital list.

- We allowed other providers offering a restricted choice of consultants (the guided option), in order to show their most competitive premiums.

WPA comparison with Bupa

Due to the discount for professionals being included, WPA price extremely well;

On a £250 shared responsibility WPA came in at £48.13 p/m; which is still the cheapest option available despite a number of advantages.

Considering that with the Bupa quote, should you need to claim the full £250 excess would need to be paid regardless of the size of the claim.

The Bupa quote would also mean that your no claims discount would not be protected, meaning that claims would negatively impact your renewal.

Unlike Bupa, with WPA you are also free to choose whichever consultant you wish from within their hospital list. Although it is possible to choose your consultant with Bupa that would increase their premium further.

This gives the security of a stable long term price; you can see why WPA are so appealing to professionals and business owners.

In this example, Bupa include mental health as standard which is in their favour. However beyond that WPA look superior on price, long term security and according to their reviews, customer service.

To speak to us about a quote with WPA or another provider click below or telephone using 0800 024 8685.